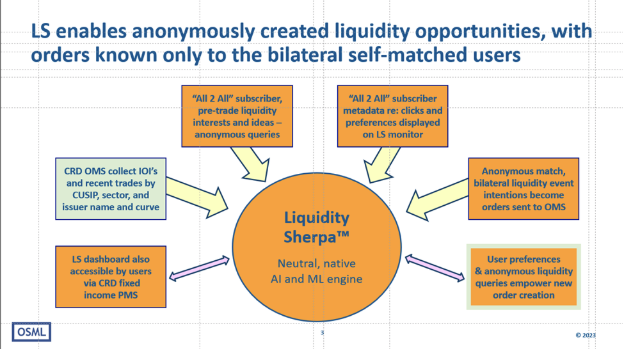

The mission of OSML is to revolutionize speed and efficiency of OTC Debt and Fixed Income trading worldwide. this breakthrough lies in the power of deep market data collection in the pre-trade cycle of market liquidity discovery. These comprehensive data sets are then exposed to rigorous AI analytics to predict optimal transaction paths for potential alignment among optimal counterparties as chosen by users themselves. This process eventually will occur anonymously in milliseconds per discovered transaction by the second year of the program.

Off the run investment grade or below investment grade sectors.

Introduce new data aggregating and analytic expansion opportunities such as automated BWICs and automated bid lists

Liquidity discovery in the pre-trade cycle, outside of traditional digital transaction platform flows – yields novel high margin data sets

Indicative bid dissemination discreetly, timely & digitally to passive holders – like custodial or endowment holdings

Streaming bid and offer levels expand numbers of instances per hour or day within distinct ranges or within distinct transaction lot sizes without attribution – M L model driven data

"Yes, we agree. The bids and the offers and the 'iterative voice data points' in OTC bond trading that fall to the cutting room floor and which are never recorded or captured are something we are interested in"

- ED Chidsey, former senior IHS market executive now S&P market data executive & group head - spoken July 2020